Historical aspects of the Welsh slate industry

D Dylan Pritchard MA FSS

Historical aspects of the Welsh slate industry

D Dylan Pritchard MA FSS

The half century, 1830 to 1880, was one of expansion and development in the slate industry. The acme of prosperity was reached in 1876, a year which was in many respects a record one in the history of the industry. The annual output of slate in North Wales increased from some 100,000 tons in 1832 to Over 450,000 tons in 1882. This rapid growth would have been impossible if new capital had not been attracted to the industry. The rapidly expanding domestic and foreign market, the progressive rise in slate prices, the absence of foreign competition and the negligible competition from other British slate producing areas, were all mutually determining factors which encouraged capitalists to invest in slate quarries, to develop the old established slate districts and to open out new ones. The apparently inexhaustible supply of excellent slate rock, the internal and external improvements in transport facilities, the technological improvements in methods of production, were other contributory factors which induced entrepreneurs to sink money in the trade.

No less important was the undoubted fact that some of the larger quarries were making huge profits. It was stated in the Mining Journal of August, 1862, that "a slate quarry in Cornwall has paid a dividend for the last twenty years"; this certainly could not be said of Welsh quarries, the fabulous profitability of which was widely publicised in technical journals and in books and pamphlets of all kinds. Edward Parry, author of "The Cambrian Mirror," estimated the annual profit of the Penrhyn Quarries in 1843 as £80,000. Samuel Hughes, writing in 1845 in Weale's Quarterly Papers on Engineering, also estimates the profit to be £80,000. In the same year Sir John Burgoyne in "The Blasting and Quarrying of Stone," gives the same estimate. John Hiklin in "Excursions in North Wales" gives the figure of £60,000 for 1846. C. F. Cliffe in "The Book of North Wales," gives the estimate of £70,000 for 1850. In the Mining Journal of September 9th, 1859, it is stated that the annual net profit of the Penrhyn Quarries is nearly £100,000, of the Dinorwic Quarries about £70,000, and of the Welsh Slate Company about £25,000; in the issue dated February 11th, 186o, it is argued in the editorial that the risk involved in slate quarrying was less than in any other form of mining investment and that most of the quarries were realising profits of from 50 to 100 per cent.

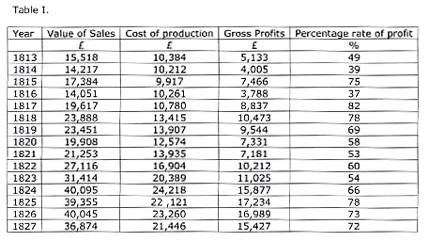

Were these reports exaggerated? It is difficult to prove their accuracy but there is some first-hand evidence on the point which gives us a good indication. Table I below gives for the Dinorwic Quarries the value of slate sold, the total cost of production, the gross profit, and the percentage rate of profit for each year between 1813 and 1827. The gross profit includes the royalty paid to Assheton Smith, who held a half share in the Dinorwic Slate Company; when he took the working of the quarry into his own hands the royalty payments automatically stopped but the gross profit includes the one-eighth share of the gross profits paid to William Turner for acting as general manager.

The percentage rate of profit is computed on the total cost of production, which includes cost of carriage from the quarries down to Port Dinorwic.

The above table indicates an exceedingly high rate of profit and there is no reason to suppose that there was any fall in the rate of profit during the following half century. Indeed, in 1856 the proprietor of the Dinorwic Quarries admitted that he was deriving a clear profit of £30,000 from the concern.

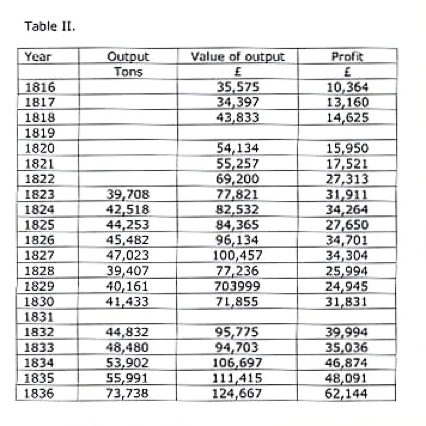

Table II. gives for most years from 1816 to 1836 the annual output of slate, the total value of production, and the net profit derived from the working of the Penrhyn Quarries.

The above table indicates a phenomenally high rate of profit, £10,000 in 1816, £35,000 in 1826, and £62,000 in 1836. By 1862 the output had gone up to 130,018 tons valued at £256,611 and for that year the profit could not possibly have been less than £100,000.

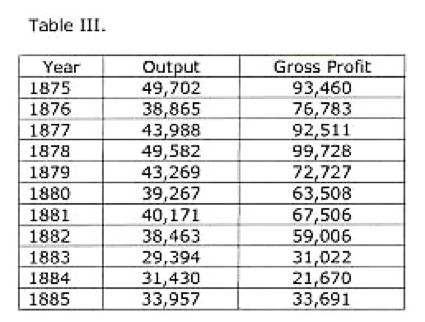

Table III. gives for each year between 1875 and 1885 the computed tonnage of output and the total gross profit, including royalty, for the Welsh Slate Company, Festiniog.

The Welsh Slate Company had been floated by Rothschild in 1825 and for the next twenty years hardly any profits were made but subsequently it became very profitable as new slate veins were discovered and opened out. In May, 1871, the company had obtained a new lease from Mr. Oakley, the land-owner, for a term of twenty-one years from December, 1869, the royalty being fixed at 7s. 9d. per ton. There were three slate mines on Mr. Oakley's estate, all worked one above the other on the same mountain so that they overlapped each other in many places. The Upper Quarry had been leased to the Hollands, the Middle Quarry to Mr. Matthews, and the Lower Quarry was leased to the Welsh Slate Company. In the 'seventies, knowing that huge profits were being made by all three concerns and realising that it was desirable that the three concerns should be worked as one productive unit, Mr. Oakley decided to take over each concern as soon as the leases expired. As it became clear that the leases were not to be renewed the lessees succumbed to the temptation to "run" the mines, and it is reliably reported that "Mr. Matthews's usual expression was to get the heart out of the damned quarry and leave the rest to the devil." As the three concerns were worked one above the other there were covenants not only between landlord and each individual lessee, but also between the different lessees, each promising to work his mine in a proper manner; for instance, it was stipulated that underground chambers were not to exceed 46ft. 6ins. in width and the intervening walls and supporting pillars were not to be less than 30 ft. wide. There was an overwhelming temptation for the lessees to increase their profits by widening their chambers and nibbling at their walls and pillars and this resulted in 1883 in a fall of nearly 6,000,000 tons in the Welsh Slate Quarry. This fall of rock buried valuable slate rock, and by causing a reduction in output and a rise in production costs it resulted in a fall in profits, as is indicated in Table III. But despite the fall in profits after 1882 the Welsh Slate Company continued to be very remunerative.

The full glare of publicity was concentrated upon the profitable larger quarries and the failure of many of the smaller undertakings to pay their way was ignored. Certain reprints from the Mining Journal show the great interest taken in the industry. A series of articles by T. C. Smith upon "Slate Quarries in North Wales" was reprinted as a pamphlet in 1860. The purpose of this pamphlet was to show "the eligibility of slate quarries as an investment and three editions of five thousand each were exhausted in about five years. Here are a few extracts from this remarkable pamphlet: "At one time the demand was confined almost entirely to roofing slates and slabs, the demand for which, within the last few years, has increased a hundred-fold, every new building now being slated; and from a calculation recently made, it would require the present produce of Wales for thirty years to cover London alone; but besides the above uses, slate is now brought into an almost endless variety of purposes, far too numerous to specify - such as cisterns, chimney-pieces, paving, and all sorts of fancy ornaments. …... The rage for building knows no bounds; at or near every railway station new towns are springing up, the houses of which are covered with the beautiful produce from the mountains of Wales. …… Look at the taste of the age; this rapid increase in population and buildings, nearly all of which have thrown over the good old tiles, which have served them so long and so well. From the mansion of the noble to the cottage of the artisan, houses are adorned with slate roofs." As one who had had ten years experience in the Welsh slate industry as agent, director and proprietor, he writes: "The result of this experience is a thorough conviction that there is no class of property with which the capitalist can deal, that offers so safe and remunerative a profit at the present time as a good slate quarry, well selected and well managed. …… Slate quarries yield profits as opened up and so notorious is this that many of our large quarries have been opened with but a small capital, and time has accomplished that which capital would have done in a much shorter time.....The capitalist should bear in mind that an investment in Welsh Slate Quarries holds out such an inducement as no other article of commerce can do. "He warned prospective investors against "The agregious follies that have been committed in some of the new companies from the want of the employment of respectable practical agents, which has extended, in some instances, to the total loss of the whole capital."

Another reprint from the Mining Journal is a pamphlet entitled "Slate Quarries as an Investment," published in 1865, and written by John Bower, managing director of the Snowdon Slate Quarries Company, Ltd. He informs us that "The demand for slates is now more than three times in excess of the supply" and mentions that "The old-fashioned tiles and straw thatch of the country cottage are rapidly giving way to the slated roof." Commenting on the failure of the industry to increase supply commensurately with the growth in demand, he writes : "No credit can be given on quantities less than fifty tons at a time sent by rail, except to customers who are in the habit of keeping large accounts on the books; 5 per cent additional price will be charged on all quantities of less than six truck loads, sent by rail to any one place or station, whether by regular customers or otherwise. No orders of any kind for less than three truck loads can be executed." In the light of subsequent developments the following two quotations are rather quaint : "Unless the speculator can achieve the impossibility of producing some manufactured substance, at a lower price, which will rival in lightness, durability, and elegance of slates, they must continue to hold their place in public esteem, and, consequently, in the public: market. No existing substance has yet even attempted to bring itself into competition"; Bower clearly never anticipated that the "old- fashioned" tile would come into its own again. The other quotation is as follows: "There has never been a strike among workmen in slate quarries, and it seems improbable (nay, even impossible) that there ever should be, because all quarrymen have a fresh contract every month at the time of taking their several bargains"; this naive statement reads strangely today because since that time many bitter and prolonged industrial disputes have marred the history of the industry. Bower regards quarry shares as "essentially a gentleman's investment." He poses the question: "Why is not the current price of shares in slate quarry limited liability companies now in operation quoted in the general share lists?" and answers, "Simply because these shares have been taken as matter of investment, and not as matter for speculation. They are so rarely transferred that not only the Stock Exchange but even the Mining Exchange, will not admit them on their lists. ….. A good quarry will return a yearly profit of from 30 to 50 per cent.; the latter is now gained at Penrhyn, the former at Dinorwic." Like Smith, he emphasises the importance of getting men with practical knowledge and experience to manage the quarries: "A practical, honest quarryman knows more of the appearance of the genuine laminating slate-rock, and of its most promising features for every working purpose, than all the Members of the Geological Society put together."

Investment in the Slate Industry 1830 - 1930 Part 1

Quarry Managers' Journal January 1943

First series

Investment 1

Second series

Third Series

Other slate information

National archive slate records

Links

Dinorwic quarry